Alabama Property Tax Records

Alabama property tax records are public documents kept by county Revenue Commissioners and Tax Assessors. Each of the 67 counties in Alabama stores property assessment data, tax bills, and payment history at the local level. The Alabama Department of Revenue sets standards for property valuation, but counties handle day-to-day assessment and collection. You can search these records online, by phone, or in person at county offices across Alabama.

Alabama Property Tax Quick Facts

How Alabama Property Taxes Work

Alabama has one of the lowest property tax burdens in the nation. The median annual tax is about $701, which is less than 25% of the national median of $3,057. This makes Alabama an affordable place to own a home. Property taxes fund local schools, roads, and public services in each county.

The state uses a three-class assessment system. Residential property is assessed at 10% of fair market value. Commercial and industrial property is assessed at 20%. Public utilities pay 30%. So if your home is worth $200,000, the assessed value for tax purposes is $20,000. The tax bill depends on the local millage rate set by your county and city.

The Alabama Department of Revenue Property Tax Division sets the rules for how counties assess property. ALDOR makes sure all 67 counties follow the same standards. They also assess public utilities, railroads, and airlines at the state level. County offices handle all other property types.

A major change took effect in 2025. Act 2024-344 created a 7% annual cap on assessed value increases for existing homeowners. This means your home's taxable value cannot jump by more than 7% in any single year, even if market prices rise faster. New construction and sales reset this cap.

What Do Property Tax Records Show?

Property tax records in Alabama contain detailed information about each parcel of land. These are public documents. Anyone can look them up. You do not need to own the property or have a special reason to search.

A typical property tax record includes:

- Parcel number and legal description

- Property address and location

- Owner name and mailing address

- Appraised value and assessed value

- Property classification (residential, commercial, etc.)

- Tax amounts owed and payment history

- Any exemptions applied (homestead, senior, etc.)

- Land size and building details

Most counties also have GIS maps that show parcel boundaries. You can click on a parcel to see the tax record. Some counties have sales data and deed information linked to the tax records as well. The level of online access varies by county.

The ALDOR County Office Directory lists contact information for every county Revenue Commissioner and Tax Assessor in Alabama. Use this to find the right office for your property search.

How to Search Property Tax Records

Most Alabama counties offer free online property searches. You can look up records from home any time of day. Each county has its own website or portal. Some use shared systems like CaptureCama, CountyGovServices, or Ingenuity. The search tools are similar across platforms.

To search online, you typically need one of these:

- Owner's last name

- Property address

- Parcel number or PIN

- Account number

Online searches are usually free. You can view assessed values, tax bills, and payment status at no cost. Some counties charge fees to download or print official documents. Others offer free printable tax receipts.

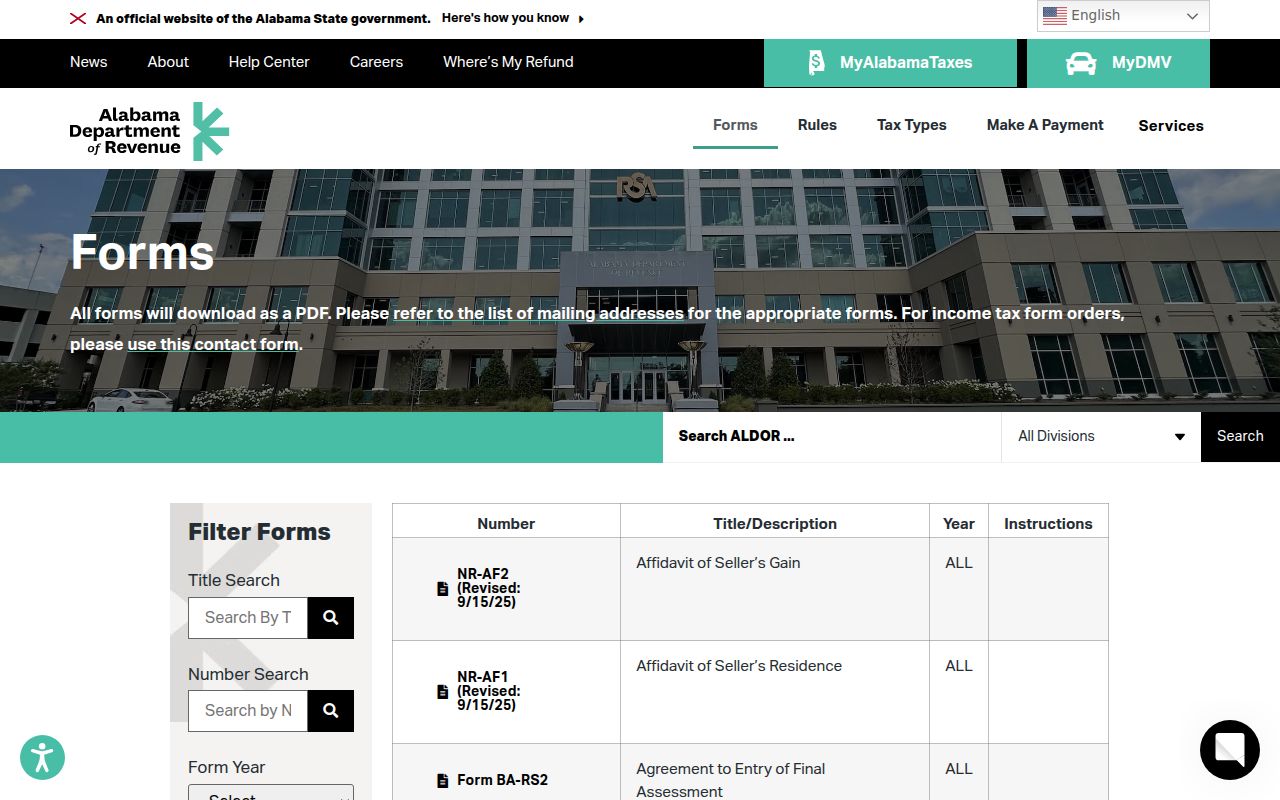

For official forms and documents, visit the ALDOR Forms Archive. You can find exemption applications, appeal forms, and other property tax documents here. Many counties also post local forms on their own websites.

In-person searches work well when you need certified copies. Go to the Revenue Commissioner or Tax Assessor office in the county where the property is located. Staff can help you find records and make copies. Bring the property address or owner name to speed up your search.

Alabama Property Tax Calendar

Alabama property taxes follow a set schedule. The tax year runs from October 1 to September 30. Taxes are paid in arrears, meaning you pay for the prior year. Here are the key dates:

- October 1: Lien date. Property ownership and value are fixed for tax purposes.

- October 1: Tax bills become due. You can pay starting this date.

- December 31: Last day to pay without penalty. Taxes become delinquent after this date.

- January 1: Interest and penalties begin on unpaid taxes.

Counties send tax bills in September or October. Some offer payment plans. Many accept credit cards online, though fees may apply. Cash, check, and money order work at all county offices. Some counties have drop boxes for after-hours payments.

Property Tax Exemptions in Alabama

Alabama offers several exemptions that can lower your property tax bill. You must apply for these. They do not happen automatically. Contact your county Revenue Commissioner to apply.

The Homestead Exemption is available to all homeowners who use the property as their main residence. Under Alabama Code § 40-9-19, this exemption reduces your taxable value. The amount saved depends on your county and city tax rates.

Seniors age 65 and older can get an additional exemption. People with disabilities may also qualify. These exemptions can eliminate all or most of the state portion of property taxes. Income limits may apply in some counties.

The Current Use program helps farmers and forest landowners. Land used for farming, timber, or wildlife habitat is assessed at its current use value rather than market value. This can mean big savings for rural property owners. You must apply and meet certain requirements to qualify.

Alabama Property Tax Laws

Alabama law governs how property is assessed and taxed. Several key statutes apply:

Alabama Code § 40-8-1 establishes property classification. This is where the 10%, 20%, and 30% assessment rates come from. The law defines what counts as each type of property.

Alabama Code § 40-7-33 requires that assessment records be preserved permanently. County offices must keep these records as public documents. This is why you can find property tax history going back many years.

Alabama Code § 36-12-40 gives every citizen the right to inspect and copy public records. This includes property tax records. You do not need to give a reason for your request. The records are open to all.

If you disagree with your assessment, Alabama Code § 40-3-24 gives you the right to appeal. You must file your appeal with the local Board of Equalization by a set deadline, usually in spring. The board will review your case and decide if the value should change.

Business Personal Property Filing

Businesses in Alabama must report equipment, inventory, and other personal property each year. The OPPAL system (Optional Personal Property Assessment Link) lets businesses file online. The filing window runs from October 1 to January 31 each year.

OPPAL is free to use. It replaced paper forms in many counties. Businesses list their equipment, furniture, and other taxable items. The county then calculates the tax based on depreciated values. Small businesses with little personal property may not owe much, but everyone must file.

Browse Property Tax Records by County

Each county in Alabama has its own Revenue Commissioner or Tax Assessor who keeps property records. Pick a county below to find local contact info and online search tools.

Property Tax Records in Major Cities

Property taxes in Alabama cities are handled at the county level. Cities may add their own millage on top of county rates. Pick a city below to learn about property taxes in that area.