Madison County Property Tax Records

Madison County property tax records are managed by separate Tax Assessor and Tax Collector offices in Huntsville. This is the second most populous county in Alabama and home to the state's largest city.

Madison County Quick Facts

Madison County Tax Assessor

Madison County is one of a few Alabama counties with separate tax offices. The Tax Assessor handles property values and exemptions. Cliff Mann serves as the current Tax Assessor. His office sets the appraised and assessed value for every property in the county. This value forms the base for your tax bill. The Tax Assessor also processes homestead and other exemption requests.

The Tax Assessor keeps detailed records on all parcels in Madison County. Staff can pull up property cards showing land size, building specs, and value history. If you think your value is wrong, this is the first office to contact. They can review your property data and fix any errors. For appeals, they can also explain the process and deadlines.

| Office | Madison County Tax Assessor |

|---|---|

| Tax Assessor | Cliff Mann |

| Address |

Madison County Courthouse 100 Northside Square Huntsville, AL 35801 |

| Phone | (256) 532-3350 |

| Hours | Monday through Friday, 8:00 AM to 4:30 PM |

| Website | madisoncountyal.gov/departments/tax-assessor |

Madison County Tax Collector

The Tax Collector handles payments and billing in Madison County. Valerie Miles serves as Tax Collector. Her office sends out tax bills each fall and collects payments. Once the Tax Assessor sets the value, the Tax Collector applies the millage rates and figures your tax. They also handle delinquent taxes, payment plans, and tax sales.

The Tax Collector office is in a different building from the Tax Assessor. For most people, this is where you go to pay your bill. The office accepts several payment methods, and you can also pay online through their website. Staff can look up your account, print receipts, and help with payment questions.

| Office | Madison County Tax Collector |

|---|---|

| Tax Collector | Valerie Miles |

| Address |

1918 Memorial Parkway NW Huntsville, AL 35801 |

| Phone | (256) 532-3370 |

| Hours | Monday through Friday, 8:00 AM to 4:30 PM |

| Website | madisoncountyal.gov/departments/tax-collector |

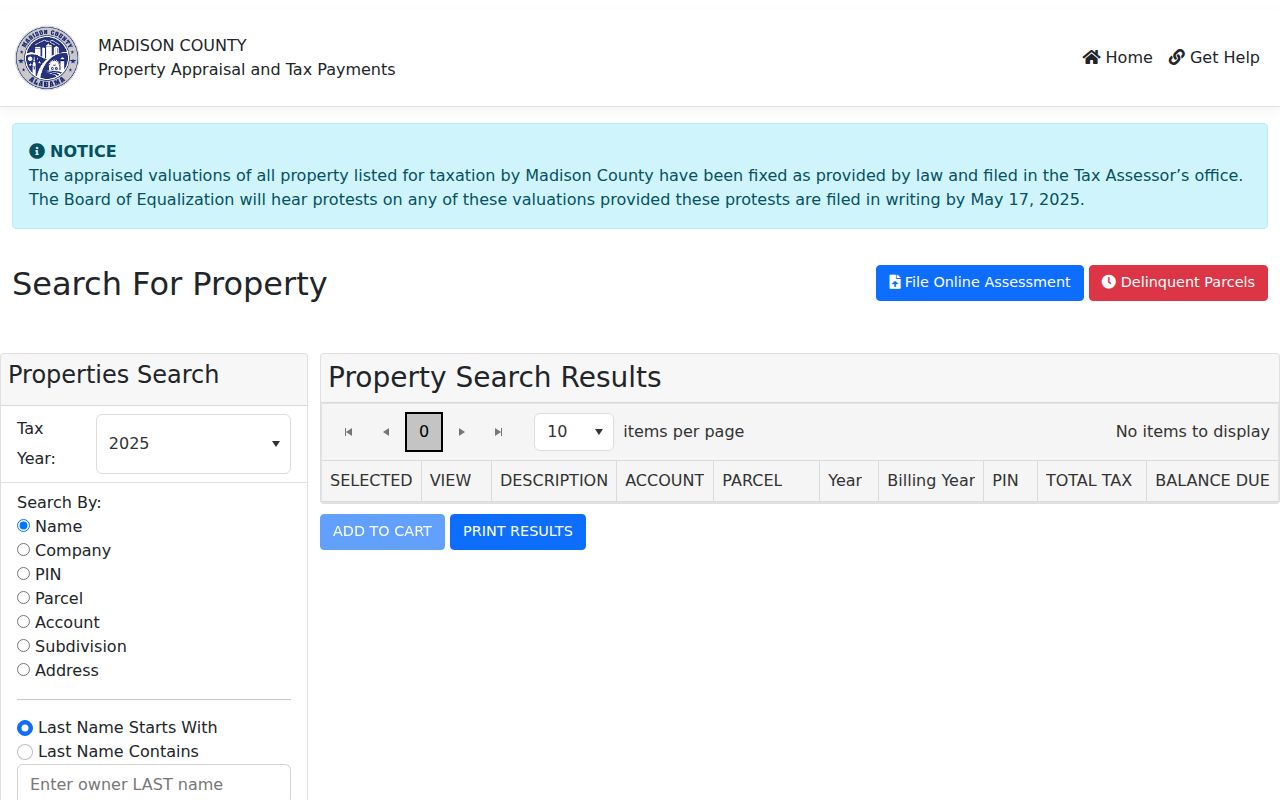

Search Madison County Property Records Online

Madison County has a strong online system for property records. The main portal is at madisonproperty.countygovservices.com. You can search by owner name, property address, or parcel ID. The system is free to use and does not need an account for basic searches. Results show property details, values, and tax information.

The county also offers GIS mapping tools. These let you view parcels on a map with aerial photos and property lines. Click on any parcel to see basic info. The GIS system links to property cards for full details. This is useful when you know where a property is but not the exact address. Madison County updates these systems regularly with current data.

Online property records in Madison County show:

- Owner name and mailing address

- Property address and legal description

- Land acreage and lot dimensions

- Building size, age, and features

- Market value and assessed value

- Tax district and millage rates

- Current year and prior year taxes

- Exemptions applied to the property

- Sales history if available

For payment history and receipts, use the Tax Collector website. You can look up past payments and print receipts for your records. The site also shows if any taxes are past due on a property in Madison County.

Madison County Property Tax Rates

Property tax rates in Madison County vary by location. The state charges 6.5 mills on all property. The county adds its own millage for schools and general fund. Cities like Huntsville and Madison add city taxes. Special districts may add more. Your total rate depends on all the taxing bodies that cover your property.

Huntsville city properties pay about $5.80 per $100 of assessed value in city tax. The City of Madison charges $6.95 per $100. These are on top of county and state rates. Properties outside city limits pay less overall since there is no city tax. The Tax Collector can tell you the exact combined rate for any parcel in Madison County.

How Madison County calculates your tax:

- Tax Assessor sets market value

- Assessment rate applied (10% for homes, 20% for business)

- Exemptions subtracted if you qualify

- Millage rates applied to assessed value

- Total is your annual property tax

Madison County has seen rapid growth, and property values have risen with it. The 2025 Alabama law caps annual assessment increases at 7% for existing owners. This helps keep tax bills from jumping too much in one year. New construction and sales are assessed at full current value.

Pay Property Taxes in Madison County

Property taxes in Madison County are due October 1. The deadline to pay without penalty is December 31. After that, interest and fees apply. The Tax Collector mails bills in September. If you do not get one, call the office or check online. You are still required to pay on time even if you miss the bill.

Madison County offers several ways to pay:

- Online at the Tax Collector website with card or eCheck

- In person at the Tax Collector office

- By mail with check or money order

- At authorized payment locations

Online payments have a small fee for card payments. Checks and eChecks usually have no added fee. When paying by mail, include your parcel number and allow enough time for delivery. The office goes by postmark date for the deadline. Late payments result in interest of 1% per month plus other fees.

If you fall behind, contact the Tax Collector about a payment plan. Getting on a plan can stop extra penalties from building up. After taxes are delinquent for several years, the property goes to a tax sale. Acting early helps you avoid that outcome in Madison County.

Property Tax Exemptions in Madison County

Madison County residents can apply for several exemptions. The homestead exemption is the most common. It removes up to $4,000 of assessed value from your primary residence. You apply once at the Tax Assessor office. Bring your deed and ID. The exemption stays on the property as long as you live there.

People age 65 and older can get the senior exemption. This removes all state property tax and may lower county taxes. You need to apply and show proof of age. Disabled residents can get a similar break. Veterans with a VA disability rating may qualify for additional exemptions. Each program has rules, so ask the Tax Assessor which ones apply to you in Madison County.

Exemptions available in Madison County:

- Homestead: Up to $4,000 off assessed value

- Senior (65+): No state tax, reduced county

- Disability: Similar to senior exemption

- Veteran disability: Based on VA rating

- Current use: Farm, timber, or wildlife land

- Historic property: For qualifying structures

The deadline to apply for exemptions is December 31 for the next tax year. New homeowners should apply soon after closing to make sure they get the exemption in time in Madison County.

Appeal Property Values in Madison County

If you disagree with your property value, you can appeal. Start at the Tax Assessor office. Staff can review your property data and fix errors. If the issue is more than a data error, you can file a formal appeal. Madison County's Board of Equalization hears these cases.

To appeal in Madison County:

- Review your notice when it arrives

- Contact Tax Assessor with concerns

- File appeal with Board of Equalization by deadline

- Gather evidence like comps, appraisals, photos

- Attend hearing and present your case

- Accept or further appeal the decision

The appeal window is limited each year. Watch for your assessment notice and act fast if you think the value is wrong. Under Code of Alabama Section 40-3-24, you have the right to dispute your value. Bring good evidence to support your case.

Related Records in Madison County

The Probate Court handles deeds and other recorded documents in Madison County. When property sells, the new deed is filed there. You can search deed records to see ownership history. The Probate Court also handles estates and may have records on inherited property.

The Circuit Clerk has court records that may involve real estate. Quiet title suits, partition cases, and foreclosure filings go through that office. For building permits and zoning info, contact the county or city planning department. Madison County has strong growth, so permit records can tell you about recent construction or changes to a property.

Cities in Madison County

Madison County contains Huntsville, the largest city in Alabama. The City of Madison is also in this county. Both have populations over 100,000. Other cities include Harvest, Meridianville, and New Hope. All property taxes go through the county Tax Assessor and Tax Collector.

Property owners in these cities pay both city and county taxes. City rates vary. Contact the Tax Collector for the combined rate on your property in Madison County.

Nearby Counties

These counties border Madison County. Make sure you know which county your property is in. You must pay taxes to the correct county.