Search Mobile County Property Tax Records

Mobile County property tax records are managed by the Revenue Commissioner. This is the second most populous county in Alabama. Note that all county offices are closed on Wednesdays.

Mobile County Quick Facts

Mobile County Revenue Commissioner

The Mobile County Revenue Commissioner handles all property tax functions. Kim Hastie serves as Revenue Commissioner. Her office appraises property, calculates taxes, and collects payments. Mobile County has one of the largest tax operations in Alabama with over 200,000 parcels to manage. The main office is on Michael Boulevard, not downtown.

Important: Mobile County offices are closed on Wednesdays. Plan your visit for Monday, Tuesday, Thursday, or Friday. The county also has satellite locations in different parts of the county. These can handle many routine tax matters without traveling to the main office.

| Office | Mobile County Revenue Commissioner |

|---|---|

| Commissioner | Kim Hastie |

| Main Address |

3925 Michael Blvd, Suite G Mobile, AL 36609 |

| Phone | (251) 574-8530 |

| Hours | Monday, Tuesday, Thursday, Friday: 8:00 AM to 4:30 PM CLOSED WEDNESDAYS |

| Website | esearch.mobilecopropertytax.com |

Mobile County Satellite Offices

Mobile County has multiple locations to serve residents across this large county. You can pay taxes, file for exemptions, and get copies at these offices. All satellite locations follow the same schedule and close on Wednesdays.

| Downtown Mobile | 151 Government Street, Mobile, AL 36602 |

|---|---|

| Tillman's Corner | 5160 Rangeline Road, Mobile, AL 36619 |

| Semmes | 8355 Moffett Road, Suite H, Semmes, AL 36575 |

| Theodore | 8301 Theodore Dawes Road, Theodore, AL 36582 |

Call ahead to confirm a location has the services you need. Some complex matters may require the main office. The satellite offices are great for payments and basic questions about property taxes in Mobile County.

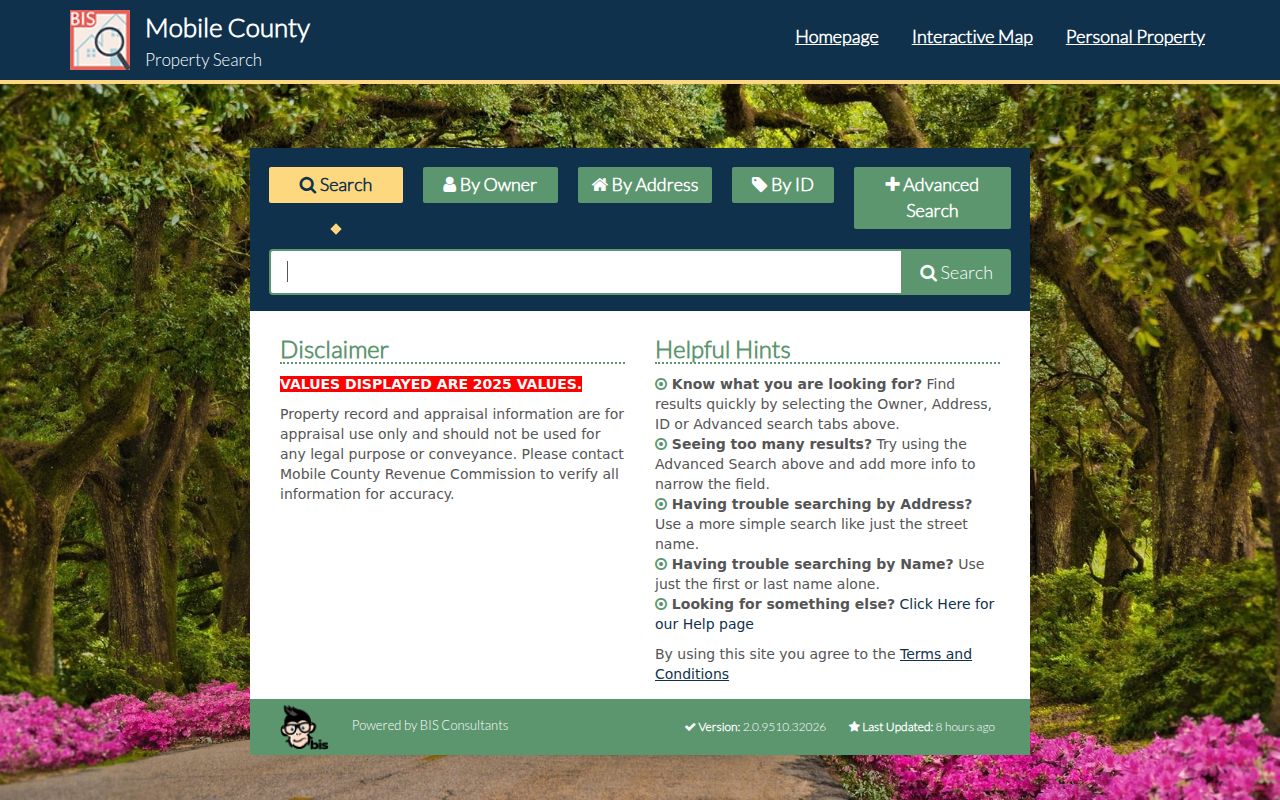

Search Mobile County Property Records Online

Mobile County has a well-developed online property search system. Visit esearch.mobilecopropertytax.com to search for any property. You can look up parcels by owner name, property address, or parcel ID number. The system is free and does not require an account for basic searches.

The online portal shows comprehensive property data. You can see ownership info, property details, values, and tax amounts. The site also offers GIS mapping tools. Click on any parcel to view its information. You can print property cards and tax records directly from the website.

Mobile County's online system includes:

- Owner name and mailing address

- Property address and legal description

- Parcel number and map location

- Land acreage and lot size

- Building square footage and features

- Year built and construction type

- Market value and assessed value

- Tax district and total millage

- Current taxes owed

- Payment history

- Exemptions applied

The online payment option lets you pay taxes from home. You can use a credit card, debit card, or bank account. There may be a fee for card payments. The site works on phones and computers, making it easy to manage your property taxes anywhere in Mobile County.

Mobile County Property Tax Rates

Mobile County property tax rates include state, county, school, and city taxes. The state charges 6.5 mills on all property. Mobile County adds millage for schools and county services. The City of Mobile adds city taxes for properties inside city limits. Your total depends on where your property is located.

Assessment rates follow Alabama law. Homes are assessed at 10% of market value. Commercial property is 20%. Agricultural land is 10% and may qualify for current use valuation. The Revenue Commissioner determines your property's market value and applies the correct assessment rate.

Typical Mobile County property tax breakdown:

- Alabama state tax: 6.5 mills

- Mobile County general fund: varies

- Mobile County schools: varies

- City of Mobile (if applicable): varies

- Special districts (if applicable): varies

Mobile County has coastal properties that may have higher values due to water access. Flood zone status can also affect property values and insurance costs. The Revenue Commissioner can explain how these factors affect your specific property tax in Mobile County.

Pay Property Taxes in Mobile County

Property taxes in Mobile County are due October 1. The deadline to pay without penalty is December 31. After that date, interest and fees begin. The Revenue Commissioner mails bills in September. Check your mail and pay on time to avoid extra costs.

Mobile County offers many ways to pay:

- Online at esearch.mobilecopropertytax.com

- In person at main office or satellite locations

- By mail with check or money order

- Drop box at county locations

Remember that offices are closed Wednesdays. If you need to pay in person, plan for another day. Online payments work any day and any time. Card payments may include a processing fee. Check or eCheck payments usually have no fee.

Late payment penalties in Mobile County:

- January 1: Interest begins at 1% per month

- Additional fees accrue over time

- After 3 years: Tax sale process begins

Contact the Revenue Commissioner if you need help paying. Options may be available to prevent losing your property.

Property Tax Exemptions in Mobile County

Mobile County residents can apply for several exemptions. The homestead exemption reduces taxes on your primary home. It removes up to $4,000 from the assessed value. Apply at the Revenue Commissioner office with your deed and ID. The exemption stays active as long as you live in the home.

Seniors age 65 and older get significant tax relief in Mobile County. The senior exemption removes all state property tax. It may also reduce county taxes depending on income. Disabled homeowners can qualify for similar relief. Veterans with a VA disability rating have their own exemption program.

Exemptions in Mobile County:

- Homestead: Up to $4,000 off assessed value

- Senior (65+): No state tax, may reduce county

- Disability: Similar to senior exemption

- Veteran: Based on VA rating

- Current use: Farm, timber, wildlife land

- Historic property: For qualifying structures

Apply by December 31 for the following tax year. New homeowners should apply soon after buying. The Revenue Commissioner can help you find all the exemptions you qualify for in Mobile County.

Appeal Property Values in Mobile County

You can challenge your property value if you believe it is too high. Start by contacting the Revenue Commissioner office. Staff can review your property data and fix any errors. Many issues are resolved at this stage. Wrong square footage, incorrect features, or outdated information are common problems that can be corrected.

If you disagree after the informal review, file a formal appeal. The Mobile County Board of Equalization hears these cases. Present your evidence and explain why the value should be lower. Good evidence includes recent sales of similar properties, a professional appraisal, or photos showing condition issues.

How to appeal in Mobile County:

- Review your assessment notice carefully

- Contact Revenue Commissioner with concerns

- Request informal review

- File formal appeal if still in disagreement

- Attend Board of Equalization hearing

- Present evidence supporting your position

- Accept or further appeal the decision

The appeal deadline is limited each year. Watch for your notice and act fast if you want to dispute the value.

Related Records in Mobile County

Other Mobile County offices keep property-related records. The Probate Court records deeds, mortgages, and plats. When property sells, the new deed is filed there. You can search deed records to trace ownership history. The Probate Court also handles estates with property transfers.

The Circuit Clerk has court files involving real estate. Foreclosure cases, quiet title suits, and mechanic's liens go through the court. For building permits and zoning questions, contact the county or city planning office. Mobile County has a permit system for new construction and renovations.

Mobile County is Alabama's only coastal county with significant beach frontage. Properties on Dauphin Island and other coastal areas may have special considerations. Flood insurance requirements, coastal setbacks, and beach access easements can all affect property rights and values in Mobile County.

Cities in Mobile County

Mobile County includes the City of Mobile, the second largest city in Alabama. Other communities include Prichard, Chickasaw, Saraland, Satsuma, and Citronelle. Dauphin Island is also in Mobile County. All property taxes go through the county Revenue Commissioner. City residents pay city taxes on top of county and state rates.

Nearby Counties

These counties share borders with Mobile County. Verify which county your property is in for tax purposes.