Baldwin County Property Tax Records

Baldwin County property tax records are managed by the Revenue Commissioner in Bay Minette. This is the largest county by land area in Alabama, covering over 1,600 square miles along the Gulf Coast.

Baldwin County Quick Facts

Baldwin County Revenue Commissioner

Teddy J. Faust Jr. serves as Revenue Commissioner for Baldwin County. His office handles all property tax assessments and collections across this large coastal county. The main office sits in Bay Minette, but satellite locations serve the beach communities and other areas. Staff can help with tax searches, exemption applications, and payment questions.

Baldwin County has grown fast in recent years. More people move to the Gulf Shores and Orange Beach area each year. This growth means more properties to assess and more tax records to manage. The Revenue Commissioner office has added staff and upgraded systems to keep up. Their online portal makes it easy to search property tax records from anywhere in Baldwin County.

| Office | Baldwin County Revenue Commissioner |

|---|---|

| Official | Teddy J. Faust Jr. |

| Address | 312 Courthouse Square, Suite 13 Bay Minette, AL 36507 |

| Phone | (251) 937-0245 |

| Hours | Monday through Friday, 8:00 AM to 4:30 PM |

| Website | baldwinproperty.countygovservices.com |

Baldwin County Satellite Offices

Baldwin County is so large that the Revenue Commissioner runs multiple offices. This makes it easier for residents to pay taxes and get help without driving all the way to Bay Minette. Each satellite office provides the same core services as the main location.

The Foley office serves the south Baldwin area near the beaches. Gulf Shores and Orange Beach residents often use this location. The Fairhope office handles the eastern shore communities. Robertsdale has an annex too, though it was closed for renovation as of early 2025. Check the county website for current hours at each location before you visit.

| Foley Office | 201 E Section Ave, Foley, AL 36535 Phone: (251) 972-8523 |

|---|---|

| Fairhope Office | 1100 Fairhope Ave, Fairhope, AL 36532 Phone: (251) 990-4665 |

| Robertsdale Annex | 22251 Palmer St, Robertsdale, AL 36567 (Check status before visiting) |

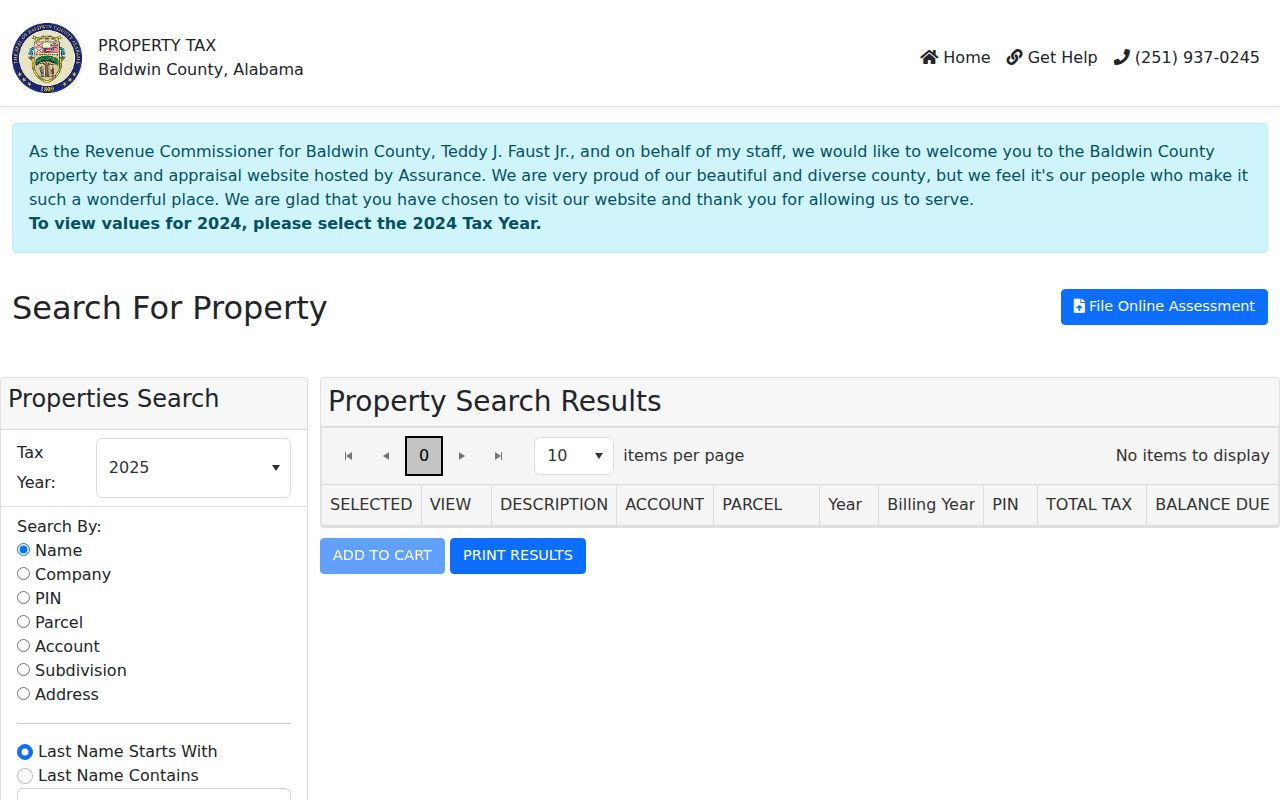

How to Search Baldwin County Property Tax Records

You can search property tax records in Baldwin County online for free. The county portal at baldwinproperty.countygovservices.com has all active parcels. Search by name, address, or parcel number. The site shows assessed values, tax amounts, and property details including maps.

For older records or certified copies, visit one of the Revenue Commissioner offices. Staff can print records and certify them for legal use. Bring your property address or parcel ID. If you need to trace ownership back many years, the Probate Court has deed records that tie to the tax rolls.

To search Baldwin County property tax records, you can use:

- Owner name (first or last)

- Property address

- Parcel identification number

- Subdivision or plat name

The online search is quick. Type in a name and see all properties that person owns in Baldwin County. Click on a parcel to view the full record. You can see the building info, land size, sales history, and current tax bill. Maps show exactly where the property sits. Print the results or save them for your records.

Baldwin County Property Tax Rates

Property tax rates in Baldwin County vary by location. The state charges 6.5 mills on all property. Baldwin County adds its own millage. Cities like Gulf Shores, Fairhope, and Daphne add more if you are inside city limits. School districts also levy taxes, and these vary across the county.

Baldwin County uses Alabama's class system. Your home is assessed at 10% of market value. Commercial property is 20%. Utilities are 30%. So a beach house worth $400,000 has an assessed value of $40,000. Your tax bill is that $40,000 times the total millage rate for your area in Baldwin County.

Typical millage components in Baldwin County:

- State of Alabama: 6.5 mills

- Baldwin County general: varies

- School district: varies by area

- City millage: if inside city limits

- Special fire or library districts: if applicable

Beach properties often have higher total rates due to city and special district millage. A home in Gulf Shores pays more per dollar of value than a rural home in north Baldwin County. But even the highest rates in Baldwin County are low compared to most states. The effective rate stays well under 1% in most cases.

Property Assessment in Baldwin County

The Revenue Commissioner values all real property in Baldwin County. The lien date is October 1. On that date, the county locks in your property value for the next tax year. Any changes after October 1 show up on the following year's bill. New construction, additions, and demolitions all affect your assessed value.

Alabama requires a four-year reappraisal cycle. Each year, roughly 25% of Baldwin County parcels get a fresh look. Appraisers check sales data, review permits, and sometimes visit properties. When your area comes up in the rotation, your value may change. The county mails notices when values increase so you have time to appeal if needed.

The assessment formula works like this:

- Appraisers set fair market value

- Value is multiplied by class rate (10%, 20%, or 30%)

- The result is your assessed value

- Millage rates are applied to get your tax bill

Starting in 2025, Alabama's new 7% cap limits how much your assessment can rise in a single year. This protects homeowners from big jumps when the market heats up. Baldwin County has seen strong growth, especially near the coast, so this cap may help many owners. It does not apply to new construction or major improvements.

Paying Property Taxes in Baldwin County

Property taxes in Baldwin County come due October 1 each year. You have until December 31 to pay without penalty. After that, interest starts at 1% per month. The county sends tax bills in the fall. If you do not get yours, contact the Revenue Commissioner or look it up online.

Baldwin County offers several payment methods. Online is the fastest. Go to the county portal and click on tax payments. You can use credit cards, debit cards, or e-checks. Some fees apply for card payments. In-person payments are accepted at any Revenue Commissioner office. Bring your bill or know your parcel number.

Ways to pay Baldwin County property taxes:

- Online at baldwinproperty.countygovservices.com

- In person at Bay Minette, Foley, or Fairhope offices

- By mail with check or money order

- Drop box at the courthouse

Many mortgage companies pay property taxes from escrow accounts. If your lender pays for you, they get the bill directly. Check your escrow statement to confirm taxes were paid. If you are not sure, search your parcel online to see the payment status. Unpaid taxes show as delinquent on the record in Baldwin County.

Property Tax Exemptions in Baldwin County

Baldwin County residents can apply for several exemptions to lower their tax bills. The homestead exemption is most common. It reduces the county portion of your taxes on your primary residence. You must own and occupy the home. Apply at the Revenue Commissioner office before December 31.

Seniors age 65 and over get extra relief. Under Code of Alabama Section 40-9-19, qualifying seniors can exempt a portion of their home's value from state and county taxes. Disabled veterans and totally disabled persons also qualify for exemptions. Bring proof of age or disability status when you apply in Baldwin County.

Common exemptions in Baldwin County:

- Homestead: for owner-occupied primary residence

- Senior (65+): additional reduction for state and county taxes

- Disability: for total and permanent disability

- Veteran: for 100% service-connected disability

- Current use: for agricultural and timber land

Current use valuation helps farmers, timber owners, and landowners who keep property in productive use. Instead of taxing land at its development potential, the county taxes it based on what it earns as farmland or forest. In Baldwin County, where waterfront land commands high prices, current use can provide major savings for qualifying property.

Appealing Your Property Assessment in Baldwin County

Think your property value is too high? You can appeal. Start by contacting the Revenue Commissioner office. Many issues get fixed with a phone call or visit. If the informal process does not work, file a formal appeal with the Board of Equalization. The deadline is usually in the spring.

Under Code of Alabama Section 40-3-25, you have the right to present evidence at a hearing. Bring sales data for similar properties, an independent appraisal, or photos showing issues with your property. The board reviews everything and makes a decision. They can lower your value, raise it, or keep it the same.

Steps to appeal in Baldwin County:

- Get your assessment notice

- Research comparable sales

- Contact the Revenue Commissioner first

- File a written appeal if needed

- Present your case at the Board of Equalization

Most appeals get settled before the formal hearing. The appraiser may agree with your evidence and adjust the value. If not, the board hearing is your chance to make your case. Prepare well and stick to the facts. Focus on why your property is worth less than the county says, not on whether taxes are fair in general.

Related Property Records in Baldwin County

The Revenue Commissioner handles tax records, but other offices keep related documents. The Baldwin County Probate Court records deeds, mortgages, and property transfers. For ownership history and title research, that is where to look. The Probate Court is in the same courthouse complex in Bay Minette.

Baldwin County also has a strong GIS system. You can view property maps, aerial photos, flood zones, and zoning layers online. The GIS data connects to the tax records so you can see both together. This is helpful for understanding exactly what a parcel includes and what surrounds it.

Other property-related offices in Baldwin County:

- Probate Court: deeds, mortgages, liens, ownership records

- GIS/Mapping: parcel maps, flood zones, aerials

- Building Department: permits, inspections, codes

- Planning and Zoning: land use, development rules

If you are buying property on the coast, check flood zone maps carefully. Baldwin County has a lot of flood-prone land. Flood insurance requirements tie to FEMA maps, not tax records, but the GIS system shows both. The Revenue Commissioner can tell you what taxes will cost; the GIS shows what risks you face.

Cities in Baldwin County

Baldwin County has many cities and towns, from beach communities to inland farm towns. All property taxes are assessed and collected by the county Revenue Commissioner. Cities may add their own millage but do not handle assessment or collection directly.

Major cities include Fairhope, Daphne, Gulf Shores, Orange Beach, Foley, Bay Minette, and Spanish Fort. Fairhope and Daphne are the largest, each with over 25,000 residents. None have populations over 100,000. All property tax records for these communities go through the Baldwin County Revenue Commissioner office.

Nearby Counties

These counties border Baldwin County. If you own property near a county line, check which county handles your taxes. Each has its own Revenue Commissioner and rates.