Access Lawrence County Property Tax Records

Lawrence County property tax records are maintained by the Revenue Commissioner in Moulton. Search assessed values, tax bills, and payment history online or at the courthouse.

Lawrence County Quick Facts

Lawrence County Revenue Commissioner

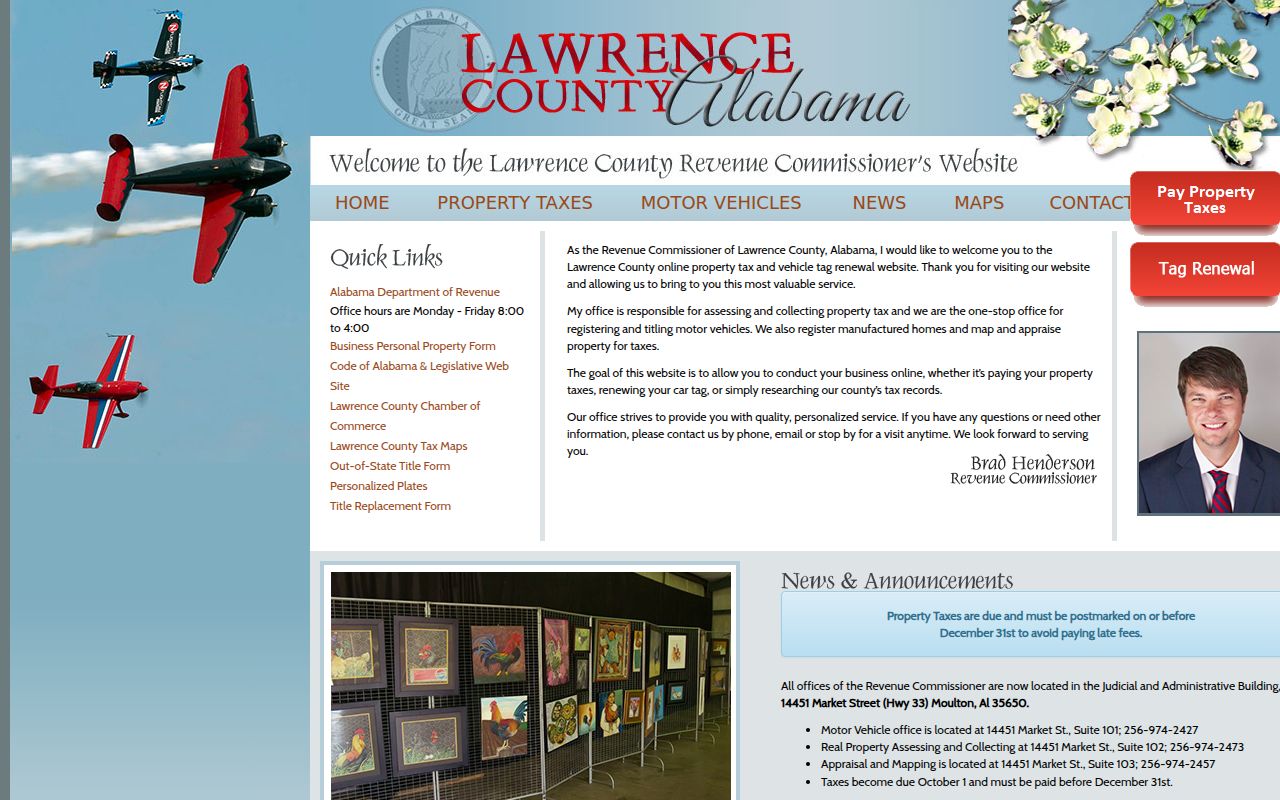

The Lawrence County Revenue Commissioner handles all property tax functions. Bradley R. Henderson serves as the current Revenue Commissioner. This office assesses property values, sends tax bills, collects payments, and maintains records for all parcels in Lawrence County. Staff can help you search records, make payments, or apply for exemptions.

The Revenue Commissioner office is in the Lawrence County Courthouse in downtown Moulton. Visit during business hours to search property records or pay your taxes. Staff can look up any property by owner name, address, or parcel number. They can print receipts and explain your property assessment in Lawrence County.

| Office | Lawrence County Revenue Commissioner |

|---|---|

| Commissioner | Bradley R. Henderson |

| Address | 14451 Court Street, Suite A Moulton, AL 35650 |

| Phone | (256) 974-2473 |

| Hours | Monday through Friday, 8:00 AM to 4:30 PM |

| Website | lawrencecountyrevenue.com |

How to Search Lawrence County Property Tax Records Online

Lawrence County has its own website for property tax searches. The system is free and available any time. Go to lawrencecountyrevenue.com to search property records.

The online system lets you search by owner name, property address, or parcel number. Results show the assessed value, tax amount, and payment status. The site displays property details and lets you pay your taxes online.

To search Lawrence County property records online, use one of these:

- Owner's last name or business name

- Property street address

- Parcel identification number

- Tax account number

Searching is free. You can view and print property data at no cost. For certified documents, contact the Revenue Commissioner office in Moulton. The site also has payment options for your property taxes in Lawrence County.

Property Assessment in Lawrence County

Lawrence County follows Alabama state law for property assessment. The county uses the standard three-class system. Residential property is assessed at 10% of fair market value. Commercial property is assessed at 20%. Public utilities are assessed at 30%. The Revenue Commissioner determines market value and applies the correct rate.

Property reappraisal happens on a four-year cycle. Each year, about 25% of the county is reviewed. This ensures all property is reappraised at least every four years. Values may change based on sales data, property improvements, or market conditions in Lawrence County.

Act 2024-344 took effect in 2025 and limits assessment increases for homeowners. The law caps rises at 7% per year. If your home's market value jumps more than 7%, your taxable value only goes up 7% until it catches up. This cap resets when property sells or undergoes major changes.

Lawrence County has a mix of rural and suburban areas. The county is close to the growing Decatur and Huntsville metro areas. Property near these cities tends to have higher values than remote rural land. The Revenue Commissioner works to assess each property type fairly based on local market conditions.

How to Pay Lawrence County Property Taxes

Tax bills go out in the fall. Taxes are due October 1 and become delinquent after December 31. Interest and penalties begin January 1 on unpaid balances. Lawrence County offers several payment options.

Pay in person at the Revenue Commissioner office in the Lawrence County Courthouse in Moulton. The office accepts cash, check, and money order. Credit and debit cards are accepted with a convenience fee. Staff will give you a receipt when you pay.

Online payments are available through lawrencecountyrevenue.com. Search for your property, then click the payment option. You can pay by credit card, debit card, or electronic check. A service fee applies to card payments.

Mail payments to Lawrence County Revenue Commissioner, 14451 Court Street, Suite A, Moulton, AL 35650. Make checks payable to Lawrence County Revenue Commissioner. Include your parcel number on the check. Mail early so payment arrives before the deadline.

Property Tax Exemptions in Lawrence County

Lawrence County offers exemptions that can reduce property taxes. You must apply for these benefits. They do not happen automatically. Contact the Revenue Commissioner to apply or check if you qualify.

The Homestead Exemption is for homeowners who use their property as a primary residence. Under Alabama Code 40-9-19, this reduces your taxable value. You must own and occupy the home as of October 1 to qualify in Lawrence County.

Seniors 65 and older may get additional exemptions. These can eliminate the state portion of property taxes. Disabled homeowners may also qualify. Income limits apply for some exemptions. Bring proof of age and income when you apply in Lawrence County.

The Current Use program helps agricultural and timber landowners. Land used for farming, timber, or wildlife habitat is assessed at its use value rather than market value. This can lower taxes for rural property owners in Lawrence County.

Appealing Your Property Assessment in Lawrence County

You have the right to appeal if you think your property value is wrong. Under Alabama Code 40-3-24, you file with the local Board of Equalization. The deadline is usually in spring. Contact the Revenue Commissioner for exact dates in Lawrence County.

Start by talking with Revenue Commissioner staff. Many issues resolve informally. Staff may find an error or explain the basis for your value. Bring evidence such as comparable sales or a recent appraisal.

If informal review does not solve the problem, file a written appeal. The Board of Equalization schedules a hearing where you present your case. Their decision can be appealed to circuit court if you still disagree in Lawrence County.

Related Records in Lawrence County

The Lawrence County Probate Court records deeds, mortgages, and property transfers. When property sells, the deed is recorded there. This triggers a review of the assessed value. The Probate Court is at the courthouse in Moulton.

Lawrence County has GIS mapping that shows parcel boundaries. The maps link to property tax data. Click on any parcel to view assessment information in Lawrence County.

Cities in Lawrence County

Lawrence County includes Moulton (the county seat), Town Creek, Courtland, Hillsboro, and North Courtland. All property taxes are assessed and collected by the county Revenue Commissioner. Cities may add their own millage on top of county rates.

No city in Lawrence County has a population over 100,000. All property tax matters are handled at the county level in Moulton.

Nearby Counties

These counties border Lawrence County. Make sure you know which county your property is in before paying taxes. Each county has its own tax office.