Sumter County Property Tax Records

Sumter County property tax records are managed by separate Tax Assessor and Tax Collector offices in Livingston. This rural county in western Alabama borders Mississippi.

Sumter County Quick Facts

Sumter County Tax Offices

Sumter County has separate Tax Assessor and Tax Collector offices. This is different from most Alabama counties that have a combined Revenue Commissioner. The Tax Assessor handles property values and exemptions. The Tax Collector handles payments and billing.

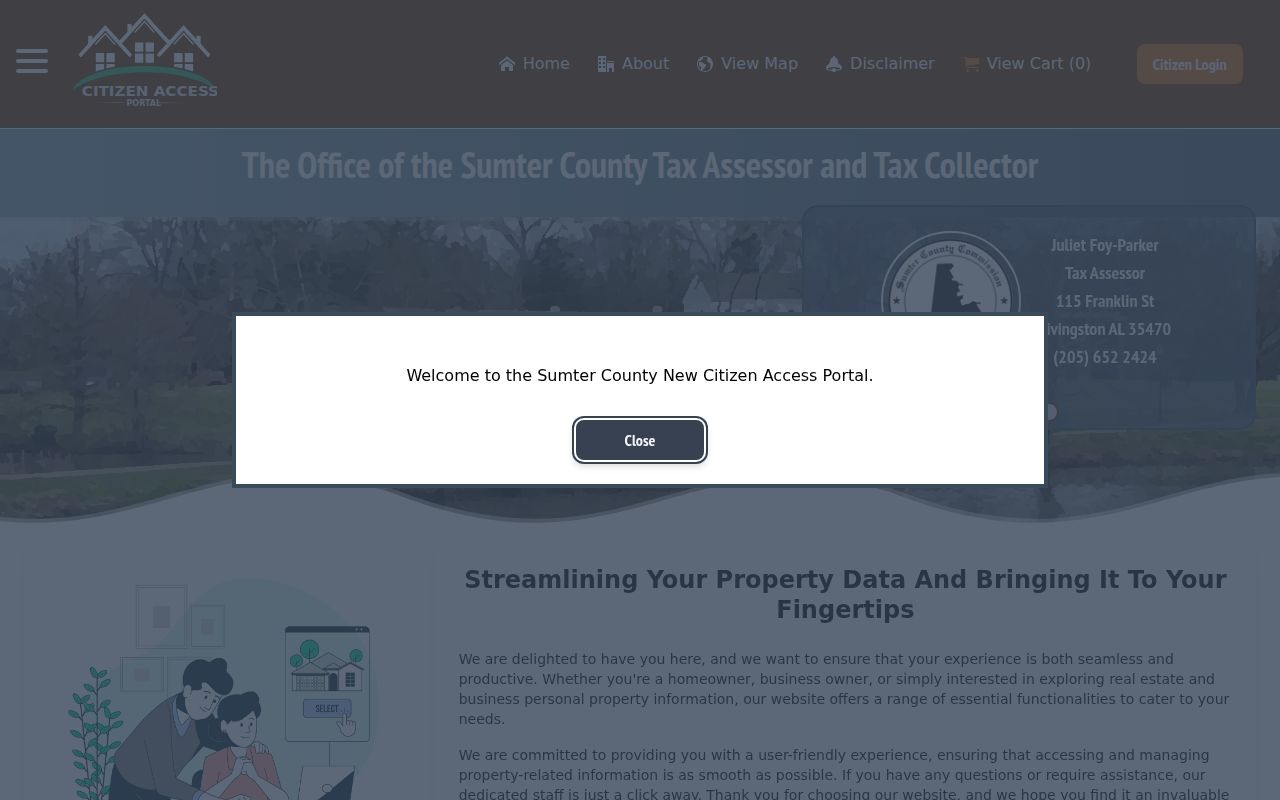

Juliet Parker serves as Tax Assessor. Her office determines property values and processes exemption applications. Randy Mask serves as Tax Collector. His office sends bills and collects payments. Both offices are in the Sumter County Courthouse in Livingston.

| Tax Assessor | Juliet Parker |

|---|---|

| Tax Collector | Randy Mask |

| Address |

Sumter County Courthouse 114 Franklin Street Livingston, AL 35470 |

| Phone (Assessor) | (205) 652-2424 |

| Hours | Monday through Friday, 8:00 AM to 4:30 PM |

| Website | sumter.capturecama.com |

Search Sumter County Property Records Online

Sumter County offers online access to property records through the Capture CAMA system. Visit sumter.capturecama.com to search any parcel for free. You can look up properties by owner name, street address, or parcel number.

The online portal shows property details and tax information. When you find a property, click to view the full record. You can see land and building data, values, and taxes. The site also has GIS mapping that shows property boundaries.

What you can find online for Sumter County:

- Property owner name and address

- Property location and legal description

- Land acreage

- Building details if applicable

- Market value and assessed value

- Tax amounts

- Exemptions applied

For detailed questions, contact the Tax Assessor for value issues or the Tax Collector for payment questions. The staff can provide more information than what appears online.

Sumter County Property Tax Rates

Property tax rates in Sumter County include state, county, and local taxes. Alabama charges 6.5 mills on all property. Sumter County adds millage for schools and county services. Cities like Livingston and York add city taxes for properties in city limits.

Assessment rates follow Alabama law. Homes are assessed at 10% of market value. Commercial property is 20%. Agricultural and timber land is 10% and may qualify for current use valuation. The Tax Assessor determines each property's class and value.

Factors affecting your Sumter County property tax:

- Property location (city or county)

- Property class (home, business, farm)

- School district

- Exemptions you qualify for

Sumter County has significant timber and farm land. The current use program helps landowners pay lower taxes on working land. Contact the Tax Assessor to learn if your property qualifies.

Pay Property Taxes in Sumter County

Property taxes in Sumter County are due October 1 each year. The deadline to pay without penalty is December 31. After that, interest and fees begin. The Tax Collector mails bills in the fall. Pay on time even if you do not receive a bill.

Sumter County accepts several payment methods:

- In person at the Tax Collector office in Livingston

- By mail with check or money order

- Online payment may be available

The office accepts cash, checks, and money orders in person. When mailing, include your parcel number and allow time for delivery. The postmark date counts for the deadline.

Late payment in Sumter County results in:

- Interest starting at 1% per month

- Additional fees over time

- Possible tax sale after several years

Contact the Tax Collector if you need help paying. Options may exist to prevent tax sale.

Property Tax Exemptions in Sumter County

Sumter County residents can apply for exemptions to lower taxes. The homestead exemption removes up to $4,000 from the assessed value on your primary home. Apply at the Tax Assessor office with your deed and ID. The exemption stays active as long as you live there.

Seniors 65 and older get significant relief in Sumter County. The senior exemption eliminates state property tax and may lower county taxes. Disabled homeowners qualify for similar benefits. Veterans with VA disability ratings have their own exemption.

Exemptions in Sumter County:

- Homestead: Up to $4,000 off assessed value

- Senior (65+): No state tax, may reduce county

- Disability: Similar to senior exemption

- Veteran: Based on VA disability rating

- Current use: Farm, timber, wildlife land

Apply by December 31 for the next year. New homeowners should apply soon after buying.

Appeal Property Values in Sumter County

If your property value seems too high, you can appeal. Start by contacting the Tax Assessor office. Staff can review your property data and fix errors. Wrong measurements or missing information are common problems.

If you disagree after the review, file a formal appeal. The Board of Equalization hears these cases in Sumter County. Present your evidence showing why the value should be lower.

Appeal process in Sumter County:

- Review your assessment notice

- Contact Tax Assessor with questions

- Request data review

- File formal appeal if needed

- Attend Board of Equalization hearing

- Present your evidence

Act fast when you get your notice. The appeal deadline is limited each year.

Related Records in Sumter County

Other Sumter County offices keep property records. The Probate Court handles deeds, mortgages, and plats. When property sells, the deed is filed there. Deed records show ownership history. The Probate Court also handles estates with property.

The Circuit Clerk has court files involving real estate. Foreclosures, quiet title suits, and liens go through the court. For building and zoning, contact the county planning office.

Livingston is home to the University of West Alabama. University property is exempt from tax. Private homes and businesses pay normal property taxes. The Tax Assessor can tell you if a specific property is taxable.

Cities in Sumter County

Sumter County contains Livingston, the county seat. Other communities include York, Cuba, and Geiger. All property taxes are assessed by the Tax Assessor and collected by the Tax Collector. City residents pay additional city taxes.

Nearby Counties

These counties border Sumter County. Verify which county your property is in for tax purposes.