Conecuh County Property Tax Records

Conecuh County property tax records are managed by the Revenue Commissioner in Evergreen. This south Alabama county is home to the Conecuh National Forest and extensive timberland.

Conecuh County Quick Facts

Conecuh County Revenue Commissioner

Jimmy Bell serves as Revenue Commissioner for Conecuh County. His office handles all property tax assessments, collections, and exemptions. Staff help with property searches, payments, and questions about values. The office also manages vehicle tags and business personal property.

The Revenue Commissioner office is in the Conecuh County Courthouse in Evergreen. This rural county has lots of timberland and farmland. Staff understand forest assessments and current use valuations. The county uses ALTAGS software for property records, which provides online access.

| Office | Conecuh County Revenue Commissioner |

|---|---|

| Official | Jimmy Bell |

| Address | Water Street Evergreen, AL 36401 |

| Phone | (251) 578-1890 |

| Hours | Monday through Friday, 8:00 AM to 4:30 PM |

| Website | altags.com/Conecuh_Revenue |

How to Search Conecuh County Property Tax Records

You can search property tax records in Conecuh County online or in person. The online portal is free and fast. For certified copies or detailed questions, visit the office.

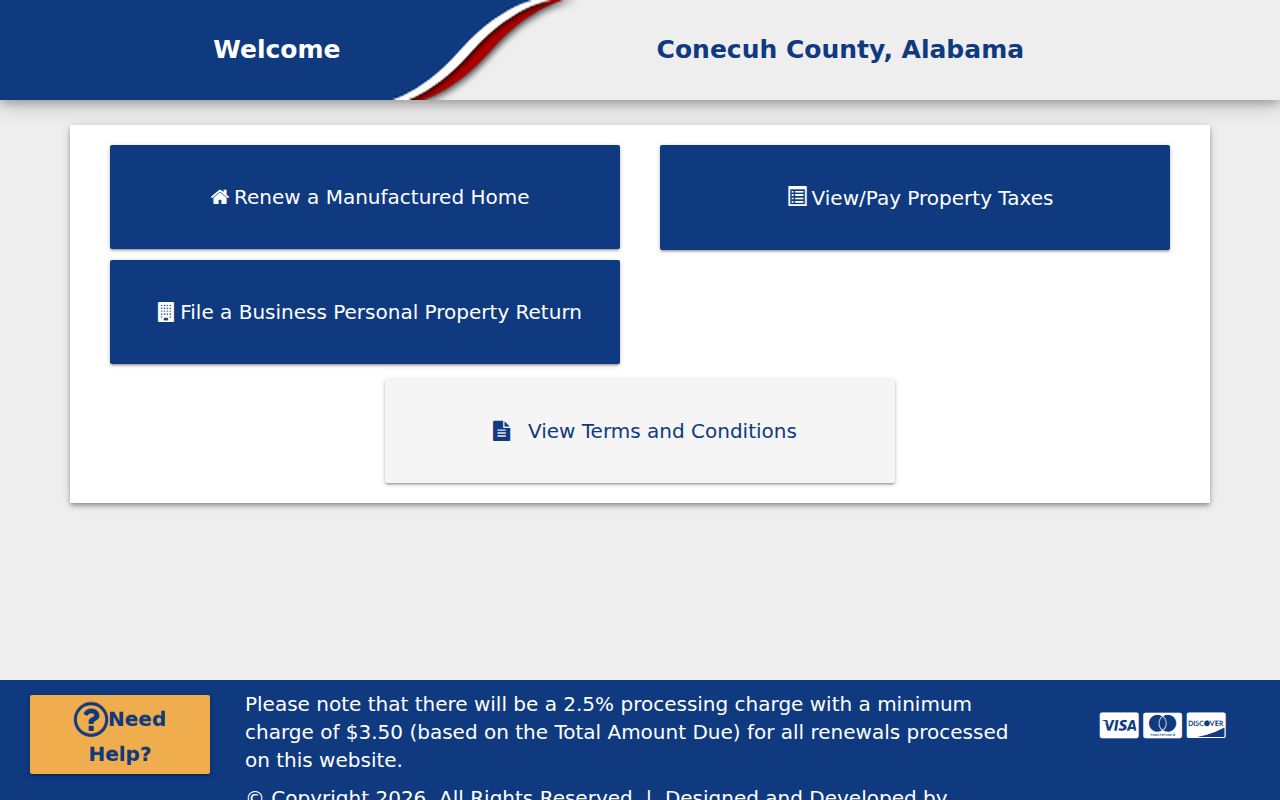

The ALTAGS portal lets you search by owner name, address, or parcel number. Results show assessed values, tax amounts, and property details. The system covers all parcels including large timber tracts in Conecuh County.

To search Conecuh County property records:

- Go to altags.com/Conecuh_Revenue

- Enter owner name, address, or parcel ID

- Click Search

- Select a property for details

For in-person help, visit the Revenue Commissioner at the courthouse in Evergreen. Staff can look up any property and print records. They know the timber market well and can explain how forest land assessments work in Conecuh County.

Conecuh County Property Tax Rates

Property tax rates in Conecuh County are low. The state charges 6.5 mills. Conecuh County adds its own rate. Evergreen adds city millage within limits. School taxes also apply.

Alabama uses three assessment classes. Homes are Class III at 10% of market value. Commercial is Class II at 20%. Utilities are Class I at 30%. A home worth $100,000 has an assessed value of $10,000. Taxes are based on that figure in Conecuh County.

Typical millage components:

- State: 6.5 mills

- County general: varies

- County schools: varies

- City: if inside city limits

Conecuh County property taxes are among the lowest in the country. The median bill is just a couple hundred dollars per year. Under Code of Alabama Section 40-8-1, property is valued at market rate, but low values and the class system keep taxes tiny.

Property Assessment in Conecuh County

The Revenue Commissioner values all real property in Conecuh County. The lien date is October 1. Your value on that date sets the next year's tax. Changes affect following years.

Alabama requires a four-year reappraisal cycle. Each year, about 25% of Conecuh County parcels get reviewed. Much of the county is timberland, which is valued based on forest productivity if enrolled in current use. The county sends notices when assessments change.

How assessment works:

- Appraisers set fair market value

- Multiply by class rate (10%, 20%, or 30%)

- Result is assessed value

- Apply millage for tax amount

Starting in 2025, Alabama caps annual increases at 7% for existing property. This adds stability though Conecuh County values rarely see big jumps. The cap does not apply to new construction.

Paying Property Taxes in Conecuh County

Property taxes in Conecuh County are due October 1 and become delinquent after December 31. Interest starts at 1% per month after that. The county mails bills in fall. Check online or call if yours does not arrive.

Conecuh County offers several payment methods. Online payment through ALTAGS accepts cards and e-checks. In-person payments work at the courthouse. Mail a check with your tax stub if you prefer.

Payment options:

- Online at altags.com/Conecuh_Revenue

- In person at the courthouse

- By mail with check

- Drop box at courthouse

Even with low bills, pay on time. If you miss the deadline, interest adds up. After years of non-payment, the county can sell your property at tax sale in Conecuh County.

Property Tax Exemptions in Conecuh County

Conecuh County offers exemptions to reduce tax bills. The homestead exemption is most common. It lowers county taxes on your primary residence. Apply before December 31.

Seniors 65 and over get extra relief under Code of Alabama Section 40-9-19. Disabled persons and veterans with 100% disability also qualify. Bring documentation.

Available exemptions:

- Homestead: for owner-occupied residence

- Senior (65+): additional relief

- Disability: for total disability

- Veteran: for 100% service-connected disability

- Current use: for farm and timber land

Current use is very important in Conecuh County. Timber land gets taxed based on forestry production, not sale potential. This provides major savings on large tracts. Apply with proof of timber management.

Appealing Your Property Assessment in Conecuh County

If your value seems wrong, you can appeal. Start with the Revenue Commissioner. Most issues get resolved quickly. If not, file with the Board of Equalization.

Under Code of Alabama Section 40-3-24, you have appeal rights. Gather evidence: comparable sales, timber cruises, or photos. Present your case at the hearing.

Appeal steps:

- Review your assessment notice

- Gather evidence

- Contact Revenue Commissioner first

- File written appeal if needed

- Attend Board of Equalization hearing

The board meets in spring. They can adjust values. Appeals are not common in Conecuh County since taxes are already so low, but you have the right.

Related Property Records in Conecuh County

The Revenue Commissioner handles tax records. The Probate Court has deeds, mortgages, and liens. For ownership history, go there. Both are in the courthouse.

Conecuh County has basic GIS mapping. The large rural parcels are shown on maps available through the county.

Other property offices:

- Probate Court: deeds, mortgages, ownership

- GIS: parcel maps

- Forestry: timber management

- Planning: zoning

Conecuh National Forest covers part of the county. If buying near federal land, check access easements and boundaries.

Cities in Conecuh County

Conecuh County has a few small towns. All property taxes go through the county Revenue Commissioner.

Communities include Evergreen (county seat), Castleberry, Repton, and Belleville. Evergreen has about 3,600 residents. None have populations over 100,000, so all property tax matters go through the Conecuh County office.

Nearby Counties

These counties border Conecuh County. Each has its own tax office.